Get notified of the latest news, insights, and upcoming industry events.

Look At The Cloud Long-Term, Beyond Acquisition.

Contributors: Richard Balmer, Director - Network Product Strategy at IPC Systems.

2022 has been transformative from an IT market data perspective, from operational resilience regulations to firms discovering the cloud’s well-documented benefits. Looking ahead, 2023 will likely see the cloud focus shift from discovery, to obtaining resilient cloud market data systems and competing against major institutions already leveraging its capabilities. In anticipation, this insight highlights both the short- and long-term considerations firms should account for, including:

- Obtaining The Cloud: Single, Multi, Hybrid, or Distributed?

- Operating The Cloud: Interoperability & Functionality.

- Managing The Cloud: Management, Visibility & Resilience.

- How CJC can help: Build, Operate & Optimise.

Obtaining The Cloud: Single, Multi, Hybrid, or Distributed?

Financial firms are without a doubt already seeking to acquire cloud-based capabilities. The immediate questions are how, where, and who. At a high level, there are generally three leading cloud service providers (CSPs) that can facilitate cloud adoption in the financial services space (AWS, Google Cloud, and Azure) and the four approaches, with respective pros and cons, including:

|

|

Single-cloud includes public and private clouds. It relies on a single CSP to supply all cloud computing needs, applications, functions and processes. The sole reliance means overseeing and managing the cloud will be more straightforward, benefitting firms with limited in-house resources and cloud-deployed workloads. However, a vendor lock-in agreement with contractual commitments and potential limitations may be included.

On the other hand, multi-cloud diversifies its reliance by partnering with multiple CSPs. This approach maintains platform independence from a single CSP, blending respective service capabilities to optimise performance and enhance agility. As multiple CSPs are involved, firms are also better positioned for comparing competitive price points to balance cost and service quality – potentially streamlining OPEX and reducing the total cost of ownership over the longer term. The downside is the inconsistency between CSPs (tools, policies, service quality, etc.), which may affect the manageability and overall resilience of a multi-cloud architecture as previously discussed.

A Hybrid cloud* is an option that combines legacy mainframe infrastructure with the cloud, enabling firms to leverage many cloud benefits without uprooting their entire legacy infrastructure – a potentially resource-intensive process. The challenge is locating the right skillsets to establish the seamless integration between market data systems and the cloud to make the hybrid environment feasible and robust*

Distributed cloud* is an architecture of multiple clouds, managed by a single panel and executed at the point of need. Viewed by users as a single cloud entity, consumers potentially benefit from reduced latency, lower network congestion, streamlined controls* and lower outage risks overall. However, a deep blended understanding of market data systems and the cloud is required for this highly customised “execute at the point of need’ build-out due to known uncertainties* and other factors including

- Bandwidth between dispersed multi-cloud environments and potentially different connectivity models may require remediation for increased throughput demands.

- Distributed cloud security. Resources are dispersed and potentially collocated with others.

- Data protection, continuity and backup strategies may need to be redesigned for the dispersed resources.

Operating The Cloud: Interoperability & Functionality

Cloud Interoperability

Regardless of the chosen approach, none is without its challenges and it is predicted* that firms will eventually be forced to perceive their infrastructure as part of a larger distributed cloud landscape. Should the prediction come to pass, acquiring blended market data and cloud technology expertise will be increasingly vital for business continuity and interoperability. This is key because, as we’ve alluded to, there are inconsistent variables between CSPs and not all stakeholders will have enlisted the same service provider.

Regardless of the chosen approach, none is without its challenges and it is predicted* that firms will eventually be forced to perceive their infrastructure as part of a larger distributed cloud landscape. Should the prediction come to pass, acquiring blended market data and cloud technology expertise will be increasingly vital for business continuity and interoperability. This is key because, as we’ve alluded to, there are inconsistent variables between CSPs and not all stakeholders will have enlisted the same service provider.

The fundamental solution will be establishing a common industry data standard to facilitate effective communications between platforms*. However, despite accelerated cloud adoptions*, this is unlikely to happen in the near term until the cloud becomes mainstream. In the interim, market data technology specialists with proven cloud expertise must ensure your market data is ready and situated (partially or wholly) in a fit-for-purpose cloud environment.

Cloud Functionality

What does a fit-for-purpose cloud environment look like? Subject to the respective objectives of individual financial firms, this will vary. However, at a high level, it revolves around designing and building functional cloud architectures that can deploy workloads currently managed in the legacy system, for example, multicast – a known barrier to cloud adoption in the financial industry. A resource and time-intensive process that requires very specialised expertise.

Reading up to this point, you have a basic awareness of some cloud pitfalls and a predicted trajectory. Your in-house team can start strategising the cloud’s build-out in time for Q1 2023, right? Wrong. This insight has interchangeably alluded to a need for specialised and blended expertise. Even if internal resources commence immediate training, it typically takes 12-18 months to theoretically understand the cloud’s mechanisms and excludes the estimated 16 months* required to migrate – not forgetting time to build out the infrastructure – an approximate turnaround time of at least 2 years and 10 months.

Reading up to this point, you have a basic awareness of some cloud pitfalls and a predicted trajectory. Your in-house team can start strategising the cloud’s build-out in time for Q1 2023, right? Wrong. This insight has interchangeably alluded to a need for specialised and blended expertise. Even if internal resources commence immediate training, it typically takes 12-18 months to theoretically understand the cloud’s mechanisms and excludes the estimated 16 months* required to migrate – not forgetting time to build out the infrastructure – an approximate turnaround time of at least 2 years and 10 months.

To lower the risk of failure and minimise turnaround time, outsourcing to seasoned specialists could reduce turnaround to only 16 months going by that estimate. In-house resources would also avoid being bottlenecked in the process and before a system handover, be trained to operate and manage the cloud.

Managing The Cloud: Management, Visibility & Resilience

Looking beyond the medium-term and based on the earlier prediction, the overarching challenge facing firms will be anticipating the eventual dispersed multi-cloud landscape and subsequently, the fragmented observability highlighted in an earlier article. Consider multi-cloud visibility tools early by setting up holistic control panels to safeguard resilience and mitigate risks while establishing cloud capabilities.

Looking beyond the medium-term and based on the earlier prediction, the overarching challenge facing firms will be anticipating the eventual dispersed multi-cloud landscape and subsequently, the fragmented observability highlighted in an earlier article. Consider multi-cloud visibility tools early by setting up holistic control panels to safeguard resilience and mitigate risks while establishing cloud capabilities.

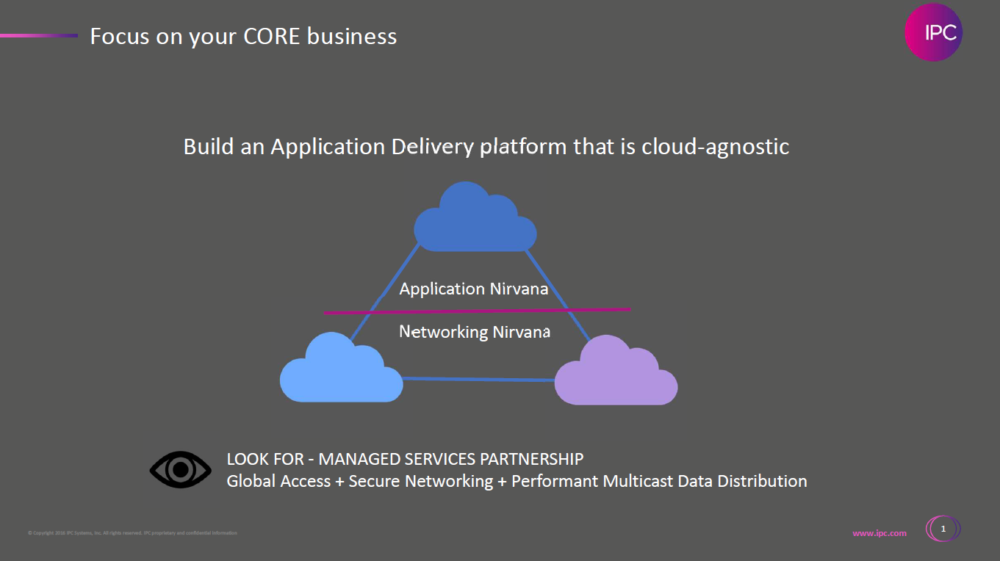

To enhance longevity and resilience, it is suggested* firms align with what was dubbed the “manifesto for the multi-cloud infrastructure partner”, enabling firms to build cloud-agnostic platforms, including:

To enhance longevity and resilience, it is suggested* firms align with what was dubbed the “manifesto for the multi-cloud infrastructure partner”, enabling firms to build cloud-agnostic platforms, including:

- Providing performance guarantees.

- Multicast distribution complexity awareness.

- Public cloud integration expertise.

- Providing a holistic visibility tool.

How CJC Can Help: Build, Operate & Optimise.

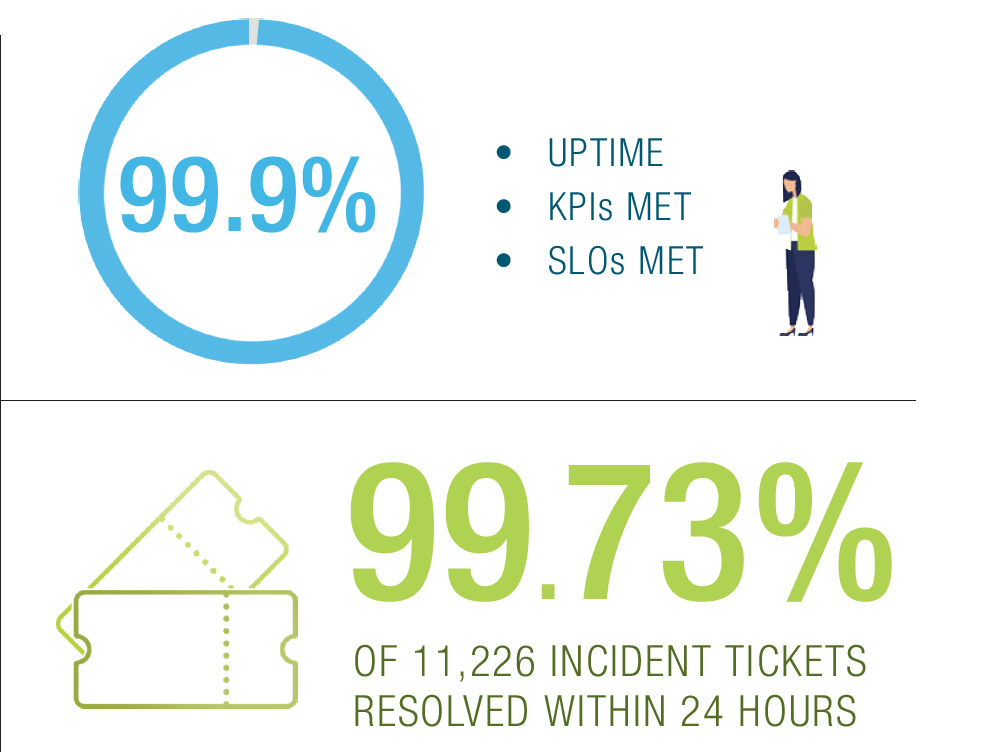

In line with the manifesto, CJC’s award-winning services are all SLA driven, achieving over 99% uptime and ticket resolution within 24 hours last year. As well as being cloud vendor-neutral, CJC was also recognised by AWS for our successful multicast in the cloud proof-of-concept earlier this year. CJC also provides a multi-cloud visibility tool called mosiacOA, which provides predictive analytics and holistic observability.

In line with the manifesto, CJC’s award-winning services are all SLA driven, achieving over 99% uptime and ticket resolution within 24 hours last year. As well as being cloud vendor-neutral, CJC was also recognised by AWS for our successful multicast in the cloud proof-of-concept earlier this year. CJC also provides a multi-cloud visibility tool called mosiacOA, which provides predictive analytics and holistic observability.

CJC is the leading market data technology consultancy and service provider for global financial markets. CJC provides multi-award-winning consultancy, operations support (OaaS), vendor-agnostic cloud solutions, and professional services for mission-critical market data systems. CJC is ISO 27001 certified and is an industry-recognised, market data specialist consultancy with over 20 years of experience.

For more information, contact us or:

Email: Marketing@cjcit.com

Tel: +44 203 328 7600

Get In Touch

Get in touch with our experts to learn how we can help you optimise

your market data ecosystem!