Get notified of the latest news, insights, and upcoming industry events.

Globally, this pandemic has affected the technology platforms used across the globe, including the capital markets. As concern and realization set in, volatility increased. Volatility led to a long-term and unprecedented rise in usage, leading to outages after outages. Several well-known market participants have been suffering from poor systems that were simply not designed or built to handle such volume.

A major internet outage hit mainstream firms as well as the capital markets on Tuesday, 22nd July 2021. As with an earlier outage, the outage was caused by a capacity issue caused by Akamai.

Capital markets tend to suffer from capacity issues, which can lead to ineffective operational resilience. The operational resilience chain, with exchanges, vendors, the sell-side and buy-side, and counterparties and partners, is only as strong as the weakest link. In order to have good capacity management, and operational resilience, volatility is just one of many challenges that must be addressed.

Transformation

In the capital markets industry specifically, the cloud is rapidly advancing and multiple mergers and acquisitions are occurring. Changes in technology, such as migration to the cloud or a change in management support staff, can cause serious outages. In many areas, capital markets use legacy technology. Specialized systems that do not fit into the cloud environment, needing specialist knowledge. An effective migration toolkit and expertise are essentials to capacity management.

When identifying its future requirements, either by a new support agency or in a cloud environment (or both), it is vital to have a thorough understanding of its performance over the course of time. Without realizing the actual capacity of the platform or how to respond to sudden capacity issues, it is easy to ‘lift and shift’ a platform to the cloud.

Solutions

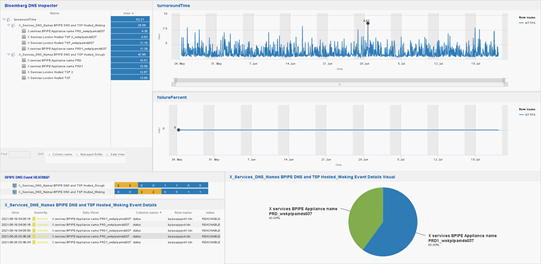

Throughout the years, CJC has consistently leveraged strong capacity planning with effective tools developed by engineers and developers who are recognized in the industry. We offer managed services based on our mosaicOA platform, which is leveraged by multiple tier one banks. CJC’s dashboards are powered by vendor technologies, message broker systems, and in-house developed applications (and DNS servers).

As a cloud-first company, CJC is now migrating world-renowned capital markets institutions to the cloud. We have partnerships with many leading cloud providers, including Google Cloud Platform. Our partnerships with telecommunications providers like BT Radianz give us highly secure and robust cloud connectivity. By using our enhanced tooling, we are able to fully understand the true performance of your systems and make accurate projections of what specifications and configuration they will need in the cloud.

In Conclusion

Recent industry panelists predicted volatility will continue to exist beyond Covid. Increasingly, businesses are moving to the cloud, which could create systems with capacity limits that could hit again. It is essential that you work with a team like CJC who has the experience, expertise, and technology that is recognized as the best in the capital markets.

Take a look at this webinar discussing how we moved Parameta Solutions and TP ICAP to the cloud.

Get In Touch

Get in touch with our experts to learn how we can help you optimise

your market data ecosystem!