Get notified of the latest news, insights, and upcoming industry events.

Cloud Multicast and Market Data

Multicast is a widely used and effective way of distributing data in the capital markets. However, it is a challenge for various capital market firms looking to transition onto the cloud. With insights from CJC's Chief Technology Officer, Peter Williams, this article explores:

Editor: Antony Fung, Marketing Manager at CJC Ltd.

Multicast and How It Works

Multicast is usually a layer three routing solution that has worked robustly on traditional servers and networking solutions. It has been a crucial staple of the capital markets and financial services since the early 2000s as an efficient and effective way of distributing data to segmented groups (one-to-many or many-to-many). The multicast data distribution process separates market data sources to specific servers and subscribers that need it, streamlining network capacity and separating data sources for regulatory requirements. Multicast ensures subscribed users all get the data simultaneously, fairly and with low latency - best execution.

Despite working well on traditional technologies, multicast has created challenges for firms wanting to transform their architecture to the cloud. Peter Williams, Chief Technology Officer at CJC discusses these issues.

Despite working well on traditional technologies, multicast has created challenges for firms wanting to transform their architecture to the cloud. Peter Williams, Chief Technology Officer at CJC discusses these issues.

Latency

"CJC never loses sight that a great percentage of the financial markets is about data distribution; it's a networking play. The cloud has huge computing power and enablement, but also, it is built on virtualisation. Without going into the weeds, that layer three multicast is effectively shifted onto a level 2 hypervisor or a virtual machine (a server running within a server). This shift is unnoticeable to the human eye; however, the firms that require low latency can be affected".

Fairness

Not only does the cloud affect low latency, but it also impacts fairness and best execution. Multicast traditionally provides market fairness by distributing data to all subscribers simultaneously. The concept of fairness is vital to exchanges and various market data vendors that need to provide 'best execution' for their customers.

Peter compares this, metaphorically, to an auction room – "First come, first served. The room is filled with would-be buyers, all in different locations around the room, with others dialling in or online. If the auctioneer came down and selectively told random individuals or groups the price before everyone else instead of simultaneously announcing the price to everyone, would that be fair to all the bidders? The answer is, of course, no. Even if it was only a small amount of time in advance, those who know the price first may act on that price whereas those that did not could miss out". Multicast is, therefore, entrenched in financial market data and why replicating this feature will be essential for any cloud-based exchange-style trading solution.

What Options Are Available?

Multicast is disabled, generally, in the cloud; however, solutions are available to deal with this. One example is the AWS Transit Gateway, which AWS describes as "the deployment of 3rd party, multicast routing capable, appliances within an Amazon Virtual Private Cloud (VPC). A tunnelling mechanism between multicast domains, outside and within AWS, is also required. The mechanics of how your on-premises multicast routers are connected with AWS are not fixed; you can utilise both public internet connectivity and private Direct Connect (DX) circuits".

CJC's Benchmark

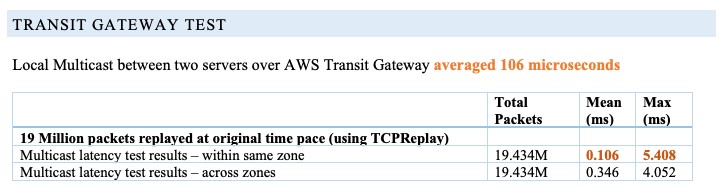

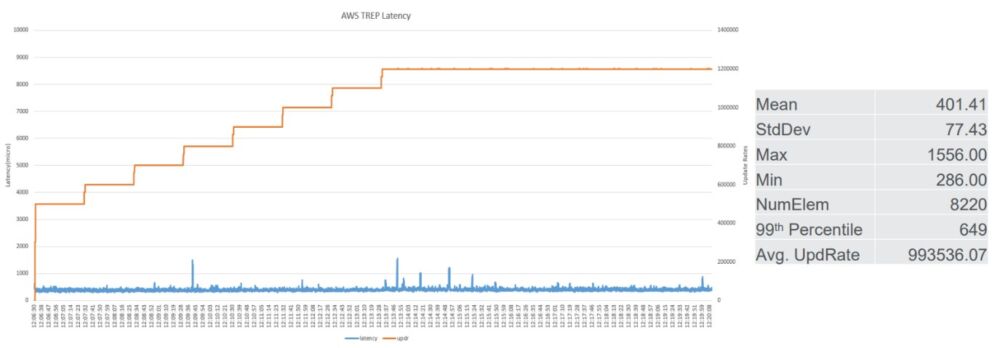

CJC completed multiple extensive testing on the AWS transit gateway. We have worked with leading exchanges and used platforms like Refinitiv's RTDS to benchmark multicast via AWS.

Exchange:

Source: CJC - Transit Gateway Test

RTDS Testing:

Source: CJC - AWS RTDS (TREP) Latency Test

Peter said, "For many firms, the use of market data is robust and resilient, but never been what can be described as 'ultra-low latency'. Many firms use normalised and consolidated market data, which is not co-located with the exchange/matching engines. The cloud here provides market data to an equivalent standard of traditional technology in these use cases".

What Can't Be Done (yet)?

Multicast becomes vital once we enter the realm of co-location to exchanges, matching engines, low latency, and fairness. The fairness in multicast is only achievable using a network switch that provides hardware-based multicast replication, efficiently duplicating multicast packets and forwarding them to multiple network ports simultaneously. For example, an enterprise CISCO switch uses an ASIC (Application-Specific Integrated Circuits) that handles this at wire speed. At this point, all packets are sent simultaneously. What happens after it goes through the switch (latency en route to the client) is a separate question. To CJC's knowledge, AWS has not provided full clarity on the 3rd party, routing-capable appliances they use.

Regarding cloud multicast solutions, there is no real magic bullet (yet). However, technology continues to evolve. Major cloud providers are actively investing in their platforms and are acutely aware of the low latency and fairness requirements that multicast must provide the financial markets.

How CJC Can Help:

CJC is the leading market data technology consultancy and service provider for global financial markets. CJC provides multi-award-winning consultancy, managed services, cloud solutions, observability, and professional commercial management services for mission-critical market data systems. CJC is ISO 27001 certified, enabling CJC’s partners the freedom to focus on their core business.

For more information, contact us or:

Email: [email protected]

Tel: +44(0) 203 328 7600

Get In Touch

your market data ecosystem!